To Invest or to Pay Off the Mortgage... That is the Question

Financial IndependenceI have gone back and forth 1,000 times. Some people are 100% certain, but I can't decide whether or not to invest my extra money or put it towards my house. My wife and I max out our IRAs every year and have been increasing our 401k contributions every raise/year. I will be close to maxing that out this year. So then what? Index funds? Mortgage? More FU Money?

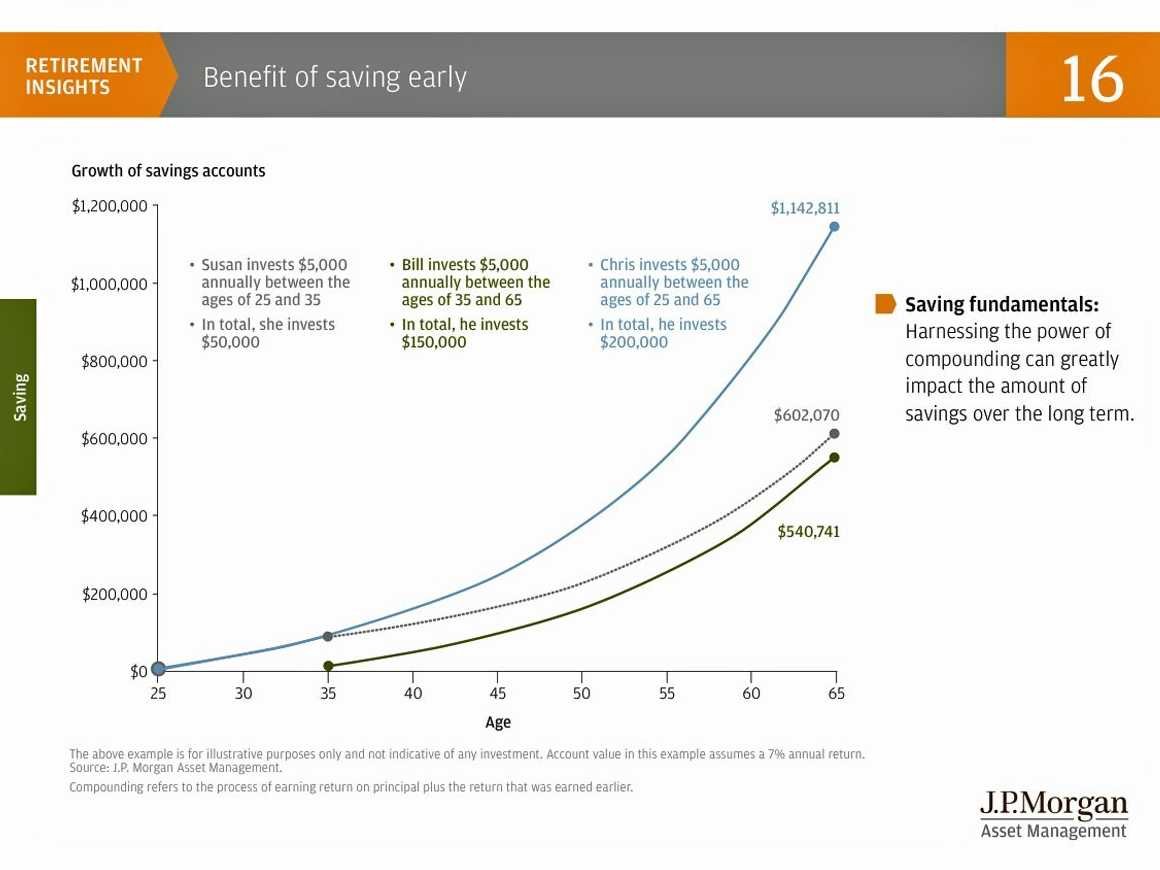

I am relatively young at 35 (now 37...) so compound interest is still a huge factor for me. Dave Ramsey suggests investing 15% of your gross income and then move on to your children's education savings and mortgage. 15% will get you somewhere after 35 years, but no where in 15. According to Mr. Money Mustache, $600k in investments can provide you with $24k worth of returns per year for as long as you will need them. So those are my targets. $600k in investments and a paid off house with $24k of annual expenses. I have found myself working towards both of these goals at the same time. Does this make sense? It is the route most people take. Reduce debt and increase investments slowly at the same time. It is balanced and has little risk. But my head says invest. That money will be fairly liquid. I will be able to spend it when/if I want. The heart says pay off ALL debt. Don't be a slave to the lender. But what does that bring? Peace of mind and less monthly expenses? Reducing expenses reduces the pressure of needing more money, but I just lost a f-ton of potential returns.

I have read hundreds of articles and forums about this topic. The ones that pay off their house say they have never once regretted it. The removal of that burden is worth the money that they could have earned with investing. The ones that invest say you are throwing money away if you don't invest it. Time can be your best friend or your worst enemy. Just look at those mind-boggling compound interest calculators. Take a look at the graph below to see compound interest in action.

That sh*t is crazy. I started an IRA in my mid-twenties, but after seeing charts like that I am pissed I didn't start sooner. That money spent on beer and gas could have changed my life 30 years from now. Then I start thinking about my expenses. Hypothetically, if you can save 100% of your income you can retire. So there are two ways to get closer to that 100% savings rate. Spend less, which would obviously entail removing a mortgage or make/save more and get your returns to pay for all of your expenses. So spending less is a huge part of Financial Independence. I am mad myself for half-assing both strategies, but at least the money is going somewhere it should. Everyone thinks what they are doing is the best... or at least they tell you that. Human beings have a tough time quantifying time and being rational with money. The brightest people I know are terrible with their money. If people were better with it, I don't think I would see a parking lot full of SUVs or houses as big as I do. People think they deserve stuff because they worked hard, but really they should just sit back, drink a tasty beer and acknowledge a job well done. Spending money doesn't give you satisfaction or fulfillment. It just provides you with a nice temporarily shiney thing that you will have to worry about keeping shiney.

So as of now, I am going to keep on keeping on. Max out retirement accounts and then hopefully throw a few hunded bucks every month at the house. I better kick my passive income stream in gear though, otherwise I am looking at years of this BS 8-5.